The leading third-party provider of Pix instant payments software issues “Pix by The Numbers” report, underscoring why Pix matters for the U.S.

Matera, maker of world-class instant payment and QR code technology for financial institutions, today released a special report detailing adoption of Brazil’s highly successful Pix system of instant payments. Pix by the Numbers provides key insights for U.S. financial institutions (FIs) as they prepare for the impending FedNow launch in July.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230518005384/en/

Matera’s Pix by the Numbers report provides key insights for U.S. financial institutions as they prepare for the impending FedNow launch in July. (Graphic: Matera)

Many U.S.-based FIs wonder how they can make money from instant payments, and Pix by the Numbers offers a glimpse into future opportunities, as Brazil’s payments landscape is significantly more mature. For example, Pix credit is an innovation FIs created on top of the Pix instant payments rail that enables banks in Brazil to make up for lost interchange revenue.

Matera’s guidance is based on its experience with Pix. The company’s Pix instant payment software processes over 3 billion instant payment transactions a year in Brazil, 20% initiated by QR code. Matera currently provides technology to more than 250 global banks, credit unions and digital banks, including two of the top three banks in the world and one-third of all banks in Brazil. Through successfully growing instant payment adoption abroad, Matera is uniquely able to assist U.S. banks, offering a complete solution adapted from one that already facilitates over 20 million QR codes per month in Brazil.

“When executed well, instant payments can transform financial systems and meet the needs of merchants and consumers much more effectively than other forms of payment, as we’ve seen firsthand,” said Carlos Netto, CEO of Matera. “That said, Brazilian banks that didn’t embrace instant payments early on were left behind, losing both customers and opportunities. As U.S. financial institutions prepare for FedNow, it’s important to know that instant payments processed through technologies like QR codes don’t have to be hard. Our software shows that true payments innovation is very much within reach.”

Pix by the Numbers Shines Light on Rapid Adoption

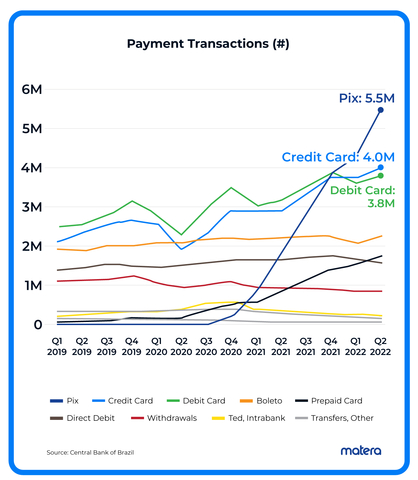

Matera shared several data points that underscore Pix’s rapid rate of adoption as well as how it is being used. For example:

- Within its first 12 months, Pix served over 100 million users.

- Last year, there were more than 24 billion Pix transactions worth approximately $2 trillion USD. That’s more than double 2021 volumes.

- The number of Pix transactions is higher than credit and debit transactions.

- While 14 billion of the total 24 billion Pix transactions in 2022 were between two people, the number of person-to-business transactions nearly quadrupled in 2022 to over 4 billion.

- As merchants continue to adopt Pix, the use of QR Codes continues to grow. Nearly 20% of instant payment transactions are initiated by QR Codes.

- As of December 2022, 63% of Pix transactions were from consumers ages 20 - 39. But consumers 40 - 59 now make up nearly 30% of Pix transactions and are growing.

This data serves as an invaluable point of reference for banks as they prepare for the future of instant payments in the U.S. With the right technology in place, financial institutions, and the merchants and consumers they serve, can be in an excellent position to take advantage of new ways to pay.

To read Pix by the Numbers in its entirety, please click here. For more information on Matera’s Payment Software, visit www.matera.com.

About Matera

Matera has extensive experience providing leading-edge instant payments and core banking solutions to financial institutions. Its world-class instant payments and QR code payments are modernizing transactions and transforming the payments landscape. In addition to its success with Pix in Brazil, Matera has adapted its technology for the U.S. market in support of RTP and the FedNow instant payments rail. Additionally, the company’s one-of-a-kind Digital Twin software works alongside a bank’s core banking platform to offer greater capacity and availability (e.g., 24X7 uptime). Digital Twin authorizes transactions, updates balances and processes instant payments in real time 100% of the time. More than 250 global banks, credit unions and digital banks rely on Matera’s solutions. Headquartered in São Paolo, Brazil and San Francisco, Matera has nearly 1,000 employees worldwide.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230518005384/en/

“When executed well, instant payments can transform financial systems and meet the needs of merchants and consumers much more effectively than other forms of payment, as we’ve seen firsthand,” said Carlos Netto, CEO of Matera.

Contacts

For Editorial Contact:

Leigh Disher

GMK Communications for Matera

leigh@gmkcommunications.com