Rocket Mortgage Ranks Highest in Customer Satisfaction

What a difference a year makes. The U.S. mortgage industry has gone from record volume and profits in 2021 to a 22-year low in demand for new mortgages through the first half of 2022.1 Along the way, J.D. Power finds that mortgage providers have struggled to differentiate themselves in the eyes of customers whose expectations of the experience are rising and competition for their business is even more intense. According to the J.D. Power 2022 U.S. Mortgage Origination Satisfaction Study℠, released today, the average mortgage customer experience has become increasingly commoditized, with few lenders finding the right formula to build long-term trust and loyalty that truly stands out from the competition.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221110005212/en/

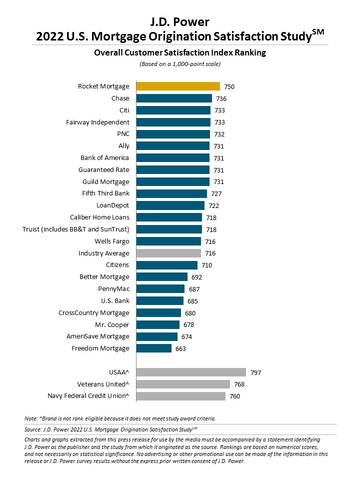

J.D. Power 2022 U.S. Mortgage Origination Satisfaction Study (Graphic: Business Wire)

"There is no denying the effects of rising interest rates on mortgage demand, and this is precisely the time when lenders need to differentiate themselves as trusted advisors who can guide customers through the lending process and offer valuable counsel along the way,” said Craig Martin, executive managing director and global head of wealth and lending intelligence at J.D. Power. “That means ramping up communication — keeping customers informed throughout the lending process and ensuring consistent and effective communications through all channels. Unfortunately, less than one in three customers say their lenders were able to deliver that optimal experience.”

Following are some key findings of the 2022 study:

- Commoditized customer experience: The top- and bottom-performing lenders in overall satisfaction in this year’s study are separated by just 87 points (on a 1,000-point scale), with very little variation in overall satisfaction among the top 10 companies evaluated. Additionally, the number one reason given for choosing a specific lender is rate, which suggests that lenders may be placing too much emphasis on price, reinforcing the notion that there is little difference beyond the product.

- Missing an opportunity: The key attributes customers are seeking in their mortgage lender are expertise; guidance; and communication. These are conveyed in the form of responsiveness, keeping customers informed, having an effective website and delivering consistent communications throughout the lending process. Currently, just 28% of lenders are successfully meeting all these key criteria.

- Less than half of mortgage customers kept fully informed: During the lending process, there are six key moments of truth that determine whether or not the lender is viewed as a trusted advisor: providing advice on customers’ financial situations; explaining the application process; fully answering application-related questions; meeting expectations for what is required; explaining the closing process; and providing information about servicing. Less than half (48%) of mortgage customers say they were kept fully informed in all the phases of the process.

- Appetite for digital, but most interactions still involve humans: While approximately 40% of mortgage customers indicate a willingness to complete the entire lending process via self-service digital tools, 67% are currently interacting with human representatives via phone.

“A rising tide of record demand and historically low interest rates hid a lot of the challenges lenders have been facing in forging more meaningful, lasting connections with customers and moving beyond a transactional, rate-driven relationship,” said Tom Lawler, head of consumer lending intelligence at J.D. Power. “Now, as the macroeconomic situation has reversed course, these relationship-driven attributes have become critical for lenders that want to convey a more unique value proposition and build more lifetime customers in a highly competitive marketplace.”

Study Ranking

Rocket Mortgage ranks highest in mortgage origination satisfaction, with a score of 750. Chase (736) ranks second, while Citi (733) and Fairway Independent (733) each rank third in a tie.

The U.S. Mortgage Origination Satisfaction Study, formerly known as the U.S. Primary Mortgage Origination Satisfaction Study, has been redesigned for 2022. It measures overall customer satisfaction based on performance in six factors (in alphabetical order): communication; digital channels; level of trust; loan offering meets my needs; made it easy to do business with; and people. The study was fielded from June through August 2022 and is based on responses from 5,915 customers who originated a new mortgage or refinanced within the past 12 months.

For more information about the U.S. Mortgage Origination Satisfaction Study, visit

https://www.jdpower.com/business/financial-services/us-mortgage-origination-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2022162.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 https://www.cnbc.com/2022/06/08/mortgage-demand-falls-to-the-lowest-level-in-22-years.html

View source version on businesswire.com: https://www.businesswire.com/news/home/20221110005212/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com