State Farm Ranks Highest in Individual Life Insurance Satisfaction

The adage that “life insurance is sold, not bought” may have met its match in the one-two punch of the COVID-19 pandemic and a federal tax code change that makes it possible for policyholders to build more cash value in their plans. According to the J.D. Power 2021 U.S. Individual Life Insurance Study,SM released today, an increase in customers’ awareness of their own mortality, combined with the ability to park assets in a tax-advantaged plan, is helping drive increased interest of— and customer satisfaction with— life insurance plans.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211014005041/en/

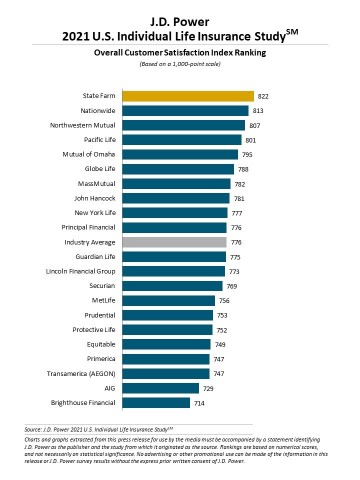

J.D. Power 2021 U.S. Individual Life Insurance Study (Graphic: Business Wire)

"Life insurance ownership has been declining for the past 30 years and overall customer satisfaction with life insurance has historically deteriorated consistently from the moment it is purchased,” said Robert M. Lajdziak, senior consultant of insurance intelligence at J.D. Power. “That’s all starting to change. This is a huge opportunity for insurers that get the customer engagement and education formula right. With the spotlight on the industry now shining brighter than ever, insurers that differentiate with simple touch points, close alignment with customer goals and clear communications are well-suited to seize the moment to build significant lifetime value.”

Following are some key findings of the 2021 study:

- Life insurance customer satisfaction surges: The overall customer satisfaction score for life insurance providers is 776 (on a 1,000-point scale), up 13 points from 2020 as customer interest in life insurance rises. While most customers are buying life insurance to cover final expenses and leave money to beneficiaries, 18% are using the policies to protect retirement income and 9% are using them for tax planning purposes.

- Agent/adviser relationship is key to satisfaction and advocacy—but mark often missed: Five key characteristics of the agent/adviser-customer relationship drive overall satisfaction and advocacy: help customers understand the policy; understand customer goals; work as a team; make recommendations in customer’s best interest; and take actions with a long-term relationship in mind. When those criteria are met, satisfaction and brand advocacy skyrocket. However, only 34% of agents/advisers meet all those criteria today.

- Website more important than ever: Insurer websites are the most frequently used communication channel for life insurance customers, with 40% now using their insurer’s website for services ranging from researching policy information to accessing their account and making payments. Overall customer satisfaction with life insurer websites climbs 24 points this year to 844.

- Leveling up communications: Overall customer satisfaction increases 50 points when customers recall receiving just one communication from their life insurance provider during the past 12 months, but only 53% of customers indicate receiving such communications. Further along the proactive communication continuum, among those who receive an email communication customer satisfaction increases 81 points and among those who receive communications tailored to meet their specific needs satisfaction increases 172 points.

Study Ranking

State Farm ranks highest among individual life insurance providers with a score of 822. Nationwide (813) ranks second and Northwestern Mutual (807) ranks third.

The 2021 U.S. Individual Life Insurance Study measures the experiences of customers of the largest individual life insurance companies in the United States. The study measures overall customer satisfaction based on performance in five factors (in alphabetical order): communication; interaction; price; product offerings; and statements.

The 2021 study is based on responses from 4,625 individual life insurance customers and was fielded in June-July 2021.

For more information about the U.S. Individual Life Insurance Study, visit https://www.jdpower.com/business/healthcare/us-individual-life-insurance-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021136.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20211014005041/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com