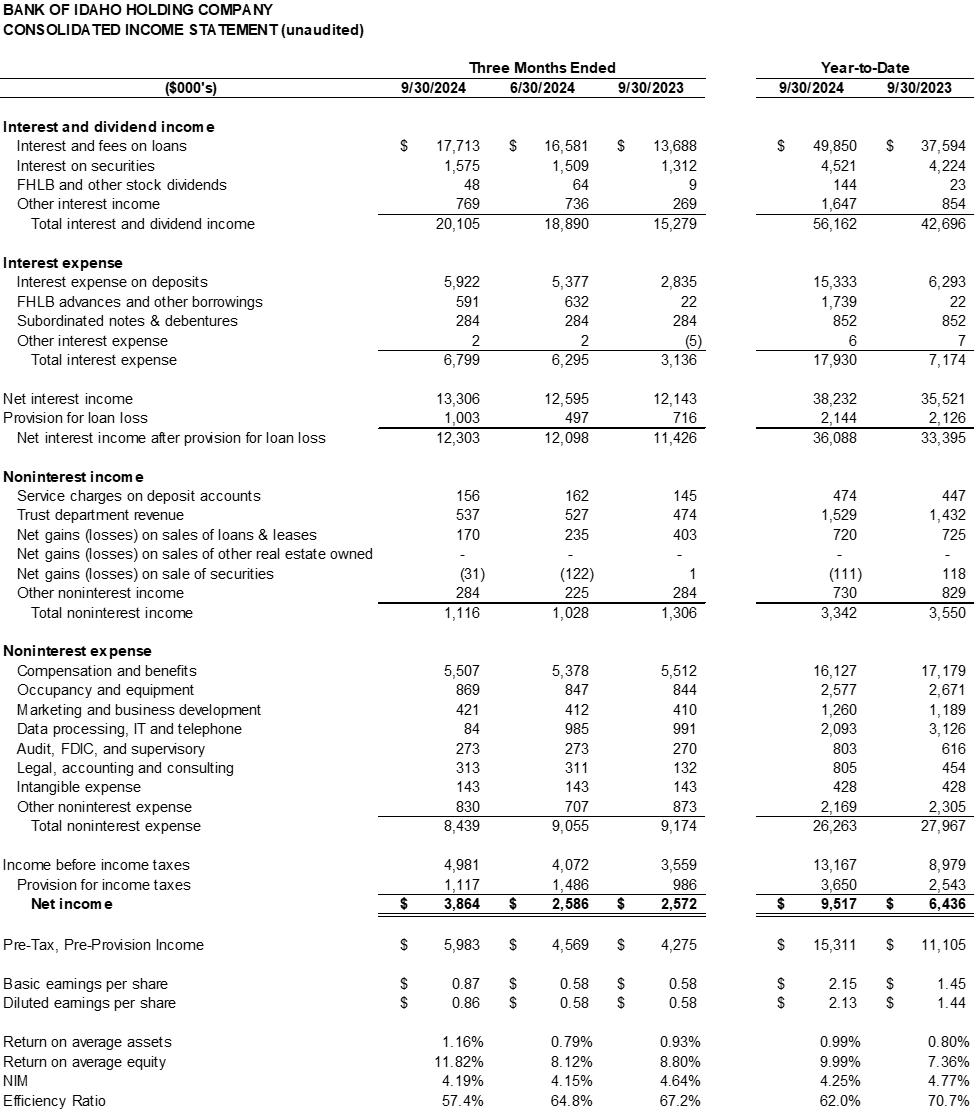

IDAHO FALLS, ID / ACCESSWIRE / October 17, 2024 / Bank of Idaho Holding Company (the "Company") (OTCQX:BOID), the holding company for Bank of Idaho (the "Bank"), today announced its unaudited financial results for the quarter ended September 30, 2024. The Company reported consolidated net income of $3,864,000, or $0.86 per diluted share, for the third quarter of 2024. This compares to $2,586,000, or $0.58 per diluted share, for the second quarter of 2024, and $2,572,000 or $0.58 per diluted share, for the third quarter of 2023. Adjusted third quarter 2024 earnings were $3,550,000, or $0.79 per diluted share, when adjusted for one-time income adjustments of $314,000, or $0.07 per diluted share.

"I am pleased to share the Company recorded a strong third quarter with the Bank of Idaho generating $5.3 million in core pre-tax, pre-provision income and $0.86 earnings per share. We successfully negotiated the renewal of our core processing contract in August, which will provide significantly enhanced digital products and business banking solutions and expect to recognize significant savings going forward. Our team remains committed to prioritizing credit, pricing, and expense discipline which continues to provide accretive results for our shareholders," said Jeff Newgard, Chairman, President, and CEO of Bank of Idaho. "Our deeply rooted relationship banking model allows us to stay closely connected with our customers, helping them navigate economic uncertainties and supporting their businesses for the long term."

Quarterly Summary

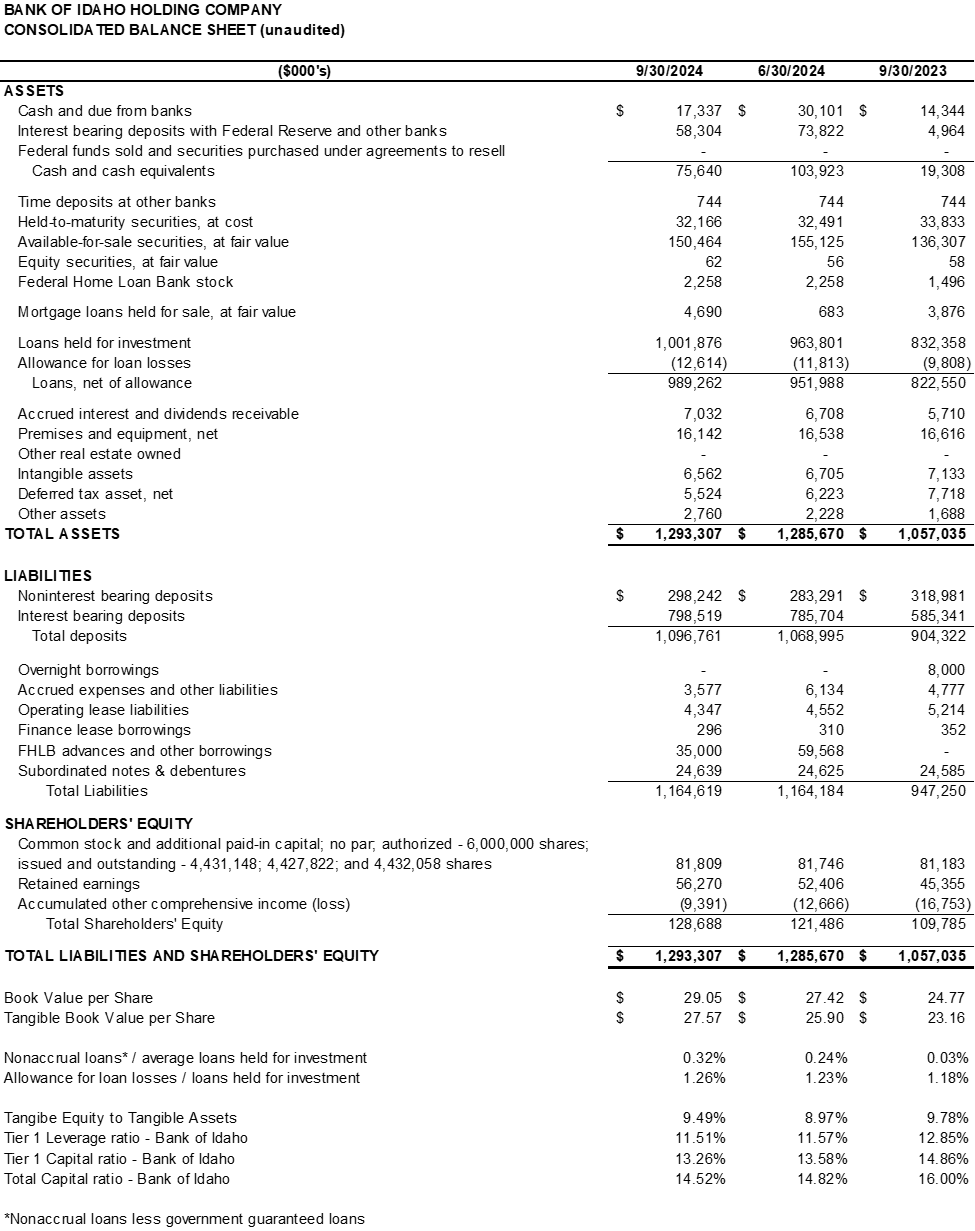

Loans held for investment grew $38.1 million, or 4.0%, in Q3 2024 and increased $169.5 million, or 20.4%, from Q3 2023.

Total core deposits increased $32.8 million, or 3.2%, in Q3 2024 and were up $195.3 million, or 22.7%, from Q3 2023.

Adjusted return on average assets ("ROAA") was 1.11% in Q3 2024, compared to 1.00% in Q2 2024 and 1.01% in Q3 2023.

Adjusted pre-tax, pre-provision net revenue ("PPNR") was $5.27 million in Q3 2024, compared to $4.69 million in Q2 2024 and $4.43 million in Q3 2023.

Tangible book value ("TBV") per share increased to $27.57, or 6.4%, from $25.90 at Q2 2024, and increased 19.0% from $23.16 at Q3 2023. The increase in TBV is attributable to earnings and a decrease in unrealized losses within our securities portfolio.

Operating Results

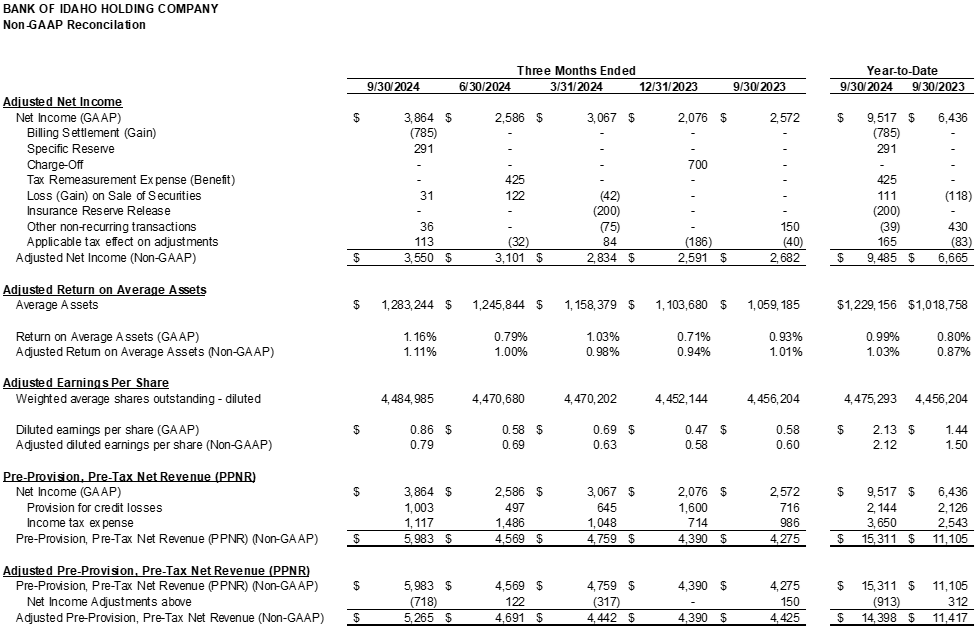

Net income for the third quarter of 2024 was $3,864,000, or $0.86 per diluted share, compared to net income of $2,586,000, or $0.58 per diluted share, for Q2 2024, and $2,572,000, or $0.58 per diluted share, for the same quarter last year. The increase from the prior quarter is the result of increased net interest income of $700,000, a one-time billing settlement gain of $785,000 and a one-time tax remeasurement expense of $425,000 in the prior quarter offset by taking a one-time provision charge of $291,000 for specific reserves in the current quarter. Please refer to the non-GAAP reconciliation attached with this press release.

Net interest income for Q3 2024 was $13.3 million, an increase of $711,000, or 5.6%, from the prior quarter as interest income outpaced the increases in interest expense. Net interest income grew $1,164,000, or 9.6%, from the same period in the prior year.

Net interest margin for the third quarter of 2024 was 4.19% compared to 4.15% in the previous quarter and 4.64% for the same quarter last year. Margin pressures remain as depositors seek higher rates. Although our moderately asset-sensitive balance sheet will be impacted by continued Fed rate cuts, we continue to see healthy loan demand at attractive rates that will allow us to defend our margin.

Noninterest income, including net gains and losses, for Q3 2024 was $1,116,000, an increase of $88,000, or 8.5%, from $1,028,000 in Q2 2024 and a decrease of $190,000, or 14.6%, from the same period in the prior year.

Noninterest expense of $8.44 million in Q3 2024 decreased $615,000, or 6.8%, from $9.06 million in Q2 2024 and a $735,000, or 8.0%, decrease from $9.17 million in Q3 2023. The decrease from Q2 2024 was due to recording a one-time billing settlement dispute of $785,000 offset by an increase of personnel expenses of $129,000 for incentive compensation. Adjusted non-interest expense for Q3 2024 was $9.19 million when reduced for non-recurring expenses. The Company's efficiency ratio was 57.4% for Q3 2024, compared to 64.8% for Q2 2024, and 67.2% for Q3 2023.

Total assets were $1.293 billion as of September 30, 2024, an increase of $7.6 million, or 0.6%, from $1.286 billion at June 30, 2024. Major changes in the Q3 2024 balance sheet came from a 4.0% growth in portfolio loans of $38.1 million. These loans were partially funded by growth in deposits of $27.8 million, or 2.6%. Other borrowings decreased by $24.6 million due to paying off the Federal Reserve's Bank Term Funding Program loan. Cash and cash equivalents decreased by $28.3 million as a result of the above activity.

Loans held for investment were $1.002 billion as of September 30, 2024, an increase of $38.1 million, or 4.0%, from $963.8 million as of June 30, 2024. This represents an increase of $169.5 million, or 20.4%, from $832.4 million as of September 30, 2023. Growth came in all loan categories, with the largest coming from an increase in the Bank's commercial and commercial real estate loans. We continue to see significant lending opportunities in all markets.

Deposits were $1.097 billion as of September 30, 2024, up $27.8 million, or 2.6%, from the previous quarter, and up $192.4 million, or 21.3%, from the same quarter last year. Non-interest-bearing deposits grew by $15.0 million, or 5.3%, from the prior quarter. We continue to see demand for interest-bearing products but we are successful in attracting deposits within our markets. Noninterest-bearing deposits represented 27% of total deposits as of September 30, 2024, the same percentage as last quarter, but down from 35% as of September 30, 2023.

Borrowings were $59.6 million as of September 30, 2024, of which $24.6 million represented subordinated debt and $35.0 million was FHLB borrowings. This compares to borrowings of $84.2 million in the prior quarter. Last quarter our borrowings were $24.6 million in subordinated debt, $24.6 million in BTFP advances, and $35.0 million in FHLB borrowings.

Asset quality remained strong in Q3 2024. Nonaccrual loans, excluding government guaranteed balances, totaled $3,165,000, or 0.32% of loans, as of September 30, 2024, compared to $2,351,000, or 0.24% of loans, as of June 30, 2024, and $3,267,000, or 0.39% of loans, as of September 30, 2023. The Company had no OREO for Q3 2024, Q2 2024, or Q3 2023.

The Allowance for Credit Losses ("ACL") totaled $12.6 million, or 1.26% of loans held for investment, as of September 30, 2024. The Company recorded $1,003,000 in provision for loan loss expense during the quarter compared to $497,000 in provision expense in the previous quarter, and $716,000 in provision for the same quarter in the prior year. The Company recorded net charge-offs of $38,000 in the third quarter of 2024 bringing year-to-date net charge-offs to $164,000 which is 2.3 basis points annualized of average loans.

Capital ratios of the Company and Bank continue to exceed the "well-capitalized" capital levels set by our respective regulators. As of September 30, 2024, the Bank's Tier 1 leverage ratio was 11.51% and the total risk -based capital ratio was 14.52%. As of September 30, 2024, the Company had tangible common equity (total stockholders' equity less intangible assets) of $122.1 million and tangible book value per share of $27.57. Tangible common equity increased $7.345 million in Q3 2024 due to quarterly earnings of $3.864 million and a $3.275 million improvement to accumulated other comprehensive loss ("AOCL") related to decreased unrealized losses on our securities portfolio. The Company's tangible common equity to tangible assets ratio was 9.49% as of September 30, 2024, up from 8.97% in the previous quarter. There were no paid dividends during Q3 2024 or in any quarter presented.

About Bank of Idaho Holding Company

Bank of Idaho Holding Company is a bank holding company headquartered in Idaho Falls, Idaho. The Company's subsidiary, Bank of Idaho, is an independent commercial bank providing a range of business, personal, and mortgage banking products and services, as well as trust and wealth management services, to customers in Idaho and eastern Washington. The Company's common stock is traded on the OTCQX exchange under the symbol "BOID."

Non-GAAP Financial Measures

Some of the financial measures included in this press release are not measures of financial performance recognized in accordance with generally accepted accounting principles in the United States ("GAAP"). These non-GAAP financial measures include "efficiency ratio," "tangible common equity," "tangible common equity to tangible assets," "tangible book value per share," and "pre-tax pre-provision net income." Efficiency ratio is computed by dividing total noninterest expense, including intangible expense, by the sum of net interest income and noninterest income, including gains and losses. Tangible common equity is computed by subtracting goodwill and core deposit intangibles from total stockholders' equity. Tangible common equity to tangible assets is computed by dividing total assets, less goodwill and core deposit intangibles, by tangible common equity. Tangible book value per share is computed by dividing tangible common equity by common shares outstanding. Pre-tax, pre-provision net income is computed by adding provision for loan loss expense and income tax expense to net income. The Company believes these non-GAAP financial measures provide both management and investors with a more complete understanding of the Company's financial position and performance. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures. Not all companies use the same calculation of these measures; therefore, this presentation may not be comparable to other similarly titled measures as presented by other companies.

Forward-Looking Statements

This press release contains, among other things, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements preceded by, followed by, or that include the words "may," "could," "should," "would," "believe," "anticipate," "estimate," "expect," "intend," "plan," "projects," "outlook" or similar expressions. These statements are based upon the current belief and expectations of the Company's management team and are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond the Company's control). Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized. The inclusion of this forward-looking information should not be construed as a representation by the Company or any other person that the future events, plans, or expectations contemplated by the Company will be achieved.

All subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. The Company does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

###

Contact: Matt Borud, Bank of Idaho

Phone: 208.412.2322

Email: mattborud@bankofidaho.net

SOURCE: Bank Of Idaho Holding Co

View the original press release on accesswire.com