IDAHO FALLS, ID / ACCESSWIRE / August 9, 2022 / Bank of Idaho Holding Company (OTCQX:BOID), the holding company for Bank of Idaho, today announced results (unaudited) for the second quarter ended June 30, 2022.

Jeff Newgard, President and CEO of Bank of Idaho commented "The second quarter of 2022 was a significant chapter in the Bank of Idaho growth story. The Bank announced its expansion into Eastern Washington state with the opening of a branch in Pasco and the acquisition of five HomeStreet Bank branches in Spokane, Yakima, Dayton, Kennewick, and Sunnyside. Additionally, the Bank opened a its fourth branch in the Boise, Idaho metropolitan area. To support this expansion, the Bank of Idaho Holding Company successfully raised over $52 million in new equity capital during the quarter, although the downstream of capital to the Bank did not occur until the legal close of the branch acquisition in late July." Mr. Newgard also noted that the Bank continued to see robust core loan demand throughout the second quarter, while mortgage banking activity slowed with the increase in interest rates.

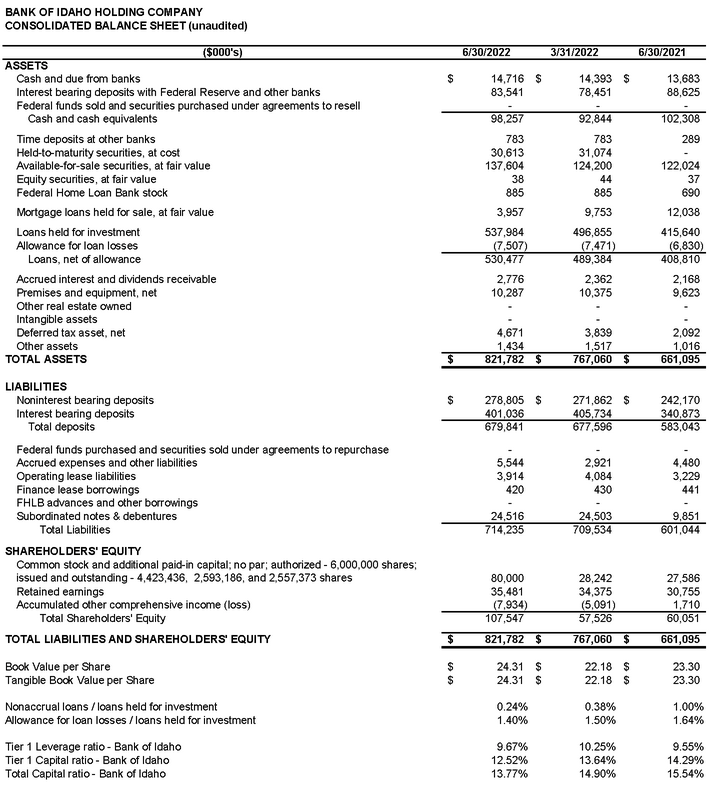

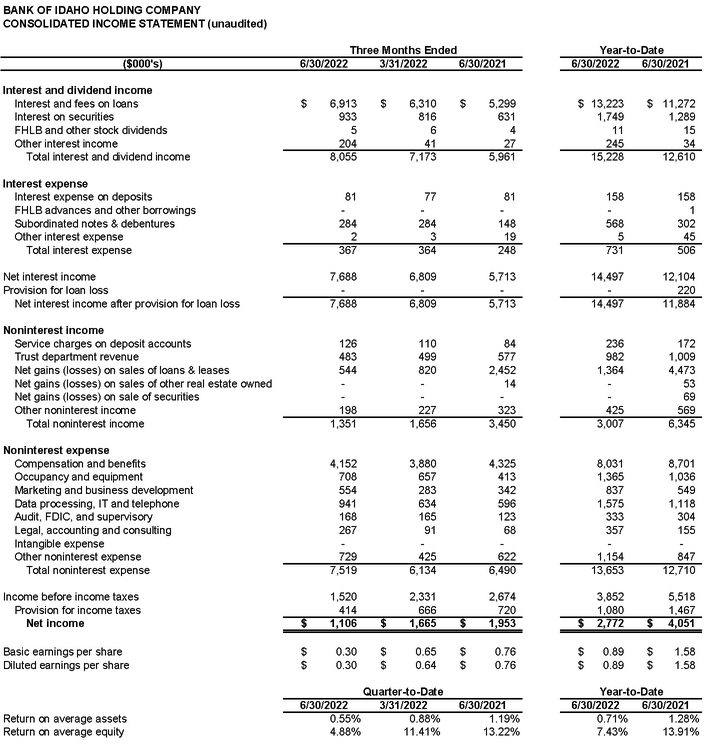

The Company's consolidated net income for the second quarter was $1,106,000 or $0.30 per diluted share, compared to $1,665,000 or $0.64 per diluted share in the previous quarter. For the three months ended June 2021, net income was $1,953,000 or $0.76 per diluted share. Assets ended the second quarter at $821.8 million, up $54.7 million (7.1%) from the prior quarter and $160.7 million (24.3%) from the prior year.

Financial Highlights:

• Total loans held for investment were $538.0 million as of June 30, 2022, an increase of $41.1 million (8.3%) for the quarter and $122.3 million (29.4%) year-over-year. Approximately 47% of the year-over-year loan growth has been from the Bank's Boisearea locations, with another 20% coming from the growing SBA department. Excluding PPP loans, total loans held for investment increased $156.6 million (41.1%) from the same period last year. PPP loans were $467,000 at quarter-end.

• Total deposits were up $2.2 million (0.3%) in the quarter and were up $96.8 million (16.6%) from a year ago to end the quarter at $679.8 million. Noninterest-bearing deposits represented 41% of total deposits on June 30, 2022 and were up $36.6 million from a year ago. The Bank has seen some slowing of deposit growth from the extraordinary increases experienced during 2021, although the pending acquisition will result in a significant increase in deposits in the third quarter.

• Second quarter net interest income of $7.7 million was $879,000 (12.9%) higher than the first quarter and $2.4 million higher than Q2 2021. The increase was driven by growing loan and securities balances, increasing asset yields, and stable funding costs.

• Noninterest income decreased $305,000 (18.4%) from the prior quarter to $1.4 million due to a continuing decline in mortgage banking revenue. The sharp increase in mortgage rates this year has reduced volume, particularly when compared to the significant activity experienced in 2020 and 2021. Year-to-date non-interest income of $3.0 million through June 30, 2022 was down $3.3 million (52.6%) from prior year, of which $3.1 million was due to the slowdown in mortgage banking. The first two quarters of 2021 also included $122,000 of combined gains on sales of securities and other real estate owned.

• Noninterest expense for the quarter increased $1.4 million (22.6%) over Q1 2022 to $7.5 million, as the Bank began to incur a variety of one-time IT, professional, and marketing expenses related to the branch acquisition, as well as increased staffing and occupancy expense related to the two new branches. The acquisition related expenses will continue into the third quarter when the transaction closes. Year-to-date noninterest expense through June 30, 2022 of $13.7 million was $942,000 (7.4%) above prior year-to-date.

• The Bank's Tier 1 Leverage Ratio was 9.67% as compared with the March 31, 2022 level of 10.25%. The Bank's Total Capital Ratio decreased to 13.77% from the prior quarter ratio of 14.90%. The Bank's capital ratios are expected to increase in the third quarter when the holding company will downstream proceeds from the recent equity raise to the Bank to support the balance sheet growth from the acquisition and branch expansion. On June 30, 2022 the holding company held $61.8 million of cash.

• Nonaccrual loans declined $586,000 during the second quarter to $1.3 million, down from $4.1 million at June 30, 2021. The Bank had no other real estate owned at quarter-end. The Bank's allowance for loan and lease losses as a percent of loans held for investment was 1.40% and no provision for loan loss was taken in Q2 2022, as the Bank had net loan recoveries of $188,000 year-to-date and credit quality indicators remained strong.

• The Company's period-end book value per share was $24.31. Book value per share was up from the prior quarter-end value of $22.18 and the prior year value of $23.30 due to the Q2 2022 capital raise and accreted earnings offsetting further increases in the unrealized losses on securities, net of tax, which have arisen due to increase in interest rates. The unrealized losses on securities, net of tax, increased to $7.9 million at June 30, 2022 from $5.1 million at March 31, 2022 due to the continued increase in market rates.

CONTACT:

Jeff Newgard

President and CEO, Bank of Idaho

208.528.3035

j.newgard@bankofidaho.net

SOURCE: Bank Of Idaho Holding Co

View source version on accesswire.com:

https://www.accesswire.com/711469/Bank-of-Idaho-Holding-Company-Reports-Second-Quarter-2022-Financial-Results