LUXEMBOURG / ACCESSWIRE / March 17, 2022 / Nexa Resources S.A. ("Nexa Resources" or "Nexa" or the "Company") (NYSE Symbol:NEXA) announces its 2021 Year-End Mineral Reserves and Mineral Resources relating to its operations and projects located in Peru and Brazil.

Commenting on the MRMR update, Ignacio Rosado, CEO of Nexa Resources, said "our mineral exploration program in 2021 was still limited by the COVID-19 protocols and consequently, affected our ability to replace Mineral Reserves. Nevertheless, our exploration program was focused on identifying new ore bodies in our operating mines and Aripuanã. We achieved positive results, with the prospective of adding new Mineral Resources in the medium-term, potentially extending our life of mine.

As a major polymetallic and the 5th largest zinc producer worldwide, Nexa has a unique portfolio of operating mines with excellent exploration potential and a pipeline of greenfield exploration projects. In 2022, our mineral exploration program will remain focused on the replacement of Mineral Reserves and upgrading Mineral Resources through infill drilling campaigns."

2021 Year-End Mineral Reserves and Mineral Resources Highlights

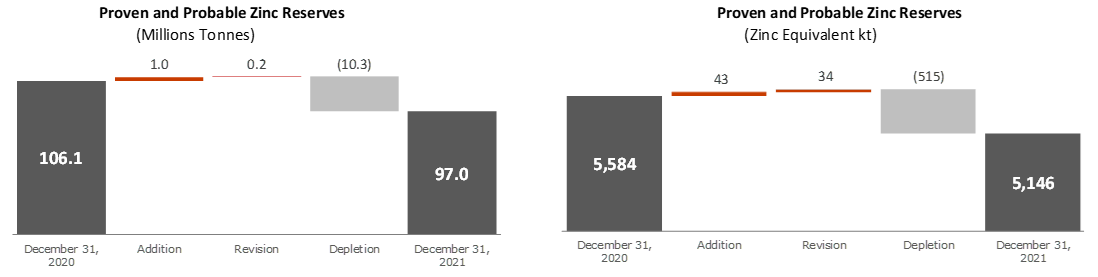

Mineral Reserves

Note: "Addition" refers to new tonnages from brownfield and infill drilling and "Revision" refers to changes in Mineral Reserves due to changes in mine design, changes in economic parameters, leading to a model review and update. Reserve numbers refer to Zinc mines and projects. Zn Equivalent kt for 2020 was updated using 2021 average metal prices.

- As of December 31, 2021, Proven and Probable Mineral Reserves estimates amounted to 97.0 million tonnes containing 5,146kt of zinc equivalent1 compared with 106.1 million tonnes containing 5,584kt of zinc equivalent as of December 31, 2020. The decrease was the result of mining production depletion. Nexa's 2021 Year-End Mineral Reserves estimate also reflects changes in continuous refining of its geological modelling.

- The depletion of -515kt zinc equivalent was partially replaced by the addition of 43kt zinc equivalent mainly as a result of drilling at El Porvenir. In 2021, Nexa's exploration program was still limited by COVID-19 health and safety protocols. The net revision of 39kt zinc equivalent was primarily due to infill drilling, increase in metal prices and cut-off value reduction at El Porvenir (111kt), and infill drilling and model update at Vazante (115kt); partially offset by mine design revision at Aripuanã (-141kt).

- The Proven and Probable Mineral Reserves at Cerro Lindo were estimated to total 44.0Mt at 1.43% Zn, 0.20% Pb, 0.62% Cu and 22.3 g/t Ag, a 15% decrease from 52.1Mt at 1.44% Zn, 0.20% Pb, 0.61% Cu and 21.2 g/t Ag as of December 31, 2020. Depletion during 2021 accounted for -6.37Mt containing 243kt of zinc equivalent.

- The Proven and Probable Mineral Reserves at Vazante were estimated to total 15.91Mt at 8.77% Zn, 0.22% Pb, and 13.7 g/t Ag, down 5% from 16.7Mt at 8.61% Zn, 0.23% Pb and 13.7 g/t Ag as of December 31, 2020. The decrease was the result of mining production depletion during 2021, which was partially replaced by drilling and updates in Extremo Norte, Sucuri Norte and Lumiadeira areas. Depletion during 2021 accounted for -1.54Mt containing 158kt of zinc equivalent.

- The Proven and Probable Mineral Reserves at El Porvenir were estimated to total 15.91Mt at 3.57% Zn, 1.04% Pb, 0.20% Cu and 69.5 g/t Ag a 10% increase from 13.9Mt at 3.75% Zn, 0.88% Pb, 0.23% Cu and 62.8 g/t Ag as of December 31, 2020. The increase is mainly the result of the infill drilling campaign. Mineral Reserve depletion accounted for -2.08Mt containing 97kt of zinc equivalent.

- The Proven and Probable Mineral Reserves at the Aripuanã project were estimated to total 21.8Mt at 3.61% Zn, 1.36% Pb, 0.23% Cu, 33.5 g/t Ag and 0.30 g/t Au a 7% decrease from 23.5Mt at 3.66% Zn, 1.36% Pb, 0.25% Cu, 34.3 g/t Ag and 0.31 g/t Au as of December 31, 2020. The decrease of -156kt of zinc equivalent was due to a revision to the stope design, pillars, and economic parameters. Mineral Reserve depletion accounted for -0.27Mt containing 17kt of zinc equivalent.

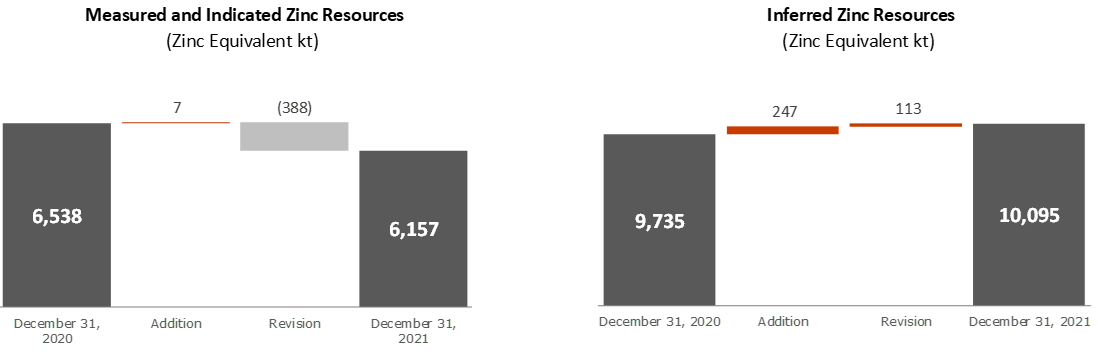

Mineral Resources

Note: "Addition" refers to new tonnages from brownfield and greenfield drilling and "Revision" refers to changes in Mineral Resources due to changes in mine design, changes in economic parameters, leading to a model review and update. Resource numbers refer to Zinc mines and projects. Zn Equivalent kt for 2020 was updated using 2021 average metal prices.

- At the 2021 year-end, Nexa estimated Measured and Indicated Mineral Resources (exclusive of mineral Reserves) of 6,157kt of contained zinc equivalent compared with 6,538kt at the end of 2020. The addition and revision accounted for a net decrease of -387kt of contained zinc equivalent.

- The addition from brownfield drilling accounted for 7kt of contained zinc equivalent at the El Porvenir mine. The revision reduced net -387kt of contained zinc equivalent mainly from Vazante (-188kt), and Aripuanã (-202kt) due to pillars and geotechnical revision at Vazante and stope design and pillars revision at Aripuanã.

- At the 2021 year-end, Nexa estimated Inferred Mineral Resources of 10,095kt of contained zinc equivalent, which is an increase from the total of 9,735kt at the end of 2020. The addition of 247kt of contained zinc equivalent was incorporated through exploration drilling. Model revisions, improvements and mine design revisions accounted for an increase of 113kt of contained zinc equivalent.

- Notable additions from exploration drilling to Inferred Mineral Resources included:

- 160kt from Vazante brownfield

- 59kt from Cerro Lindo

- Infill drilling and geological interpretation revision accounted for 97kt of contained zinc equivalent from Vazante; 64kt of contained zinc equivalent from El Porvenir and -11kt of contained zinc equivalent from Aripuanã. Geological revision at Cerro Lindo accounted for -60kt. Minor revisions from other mines and projects accounted for the remaining 23kt.

Table 1. Average Metallurgical Recoveries assumptions used for economic evaluation and zinc equivalent calculation.

Exploration Outlook

Nexa's exploration strategy for 2022 will remain focused on Mineral Resource expansion through brownfield and infill drilling near operating mines and extension drilling on advanced projects.

Geographically, we expect mineral exploration program to be approximately 40% in Brazil, 52% in Peru, and the remainder in other geographies.

Our 2022 drilling program on brownfield projects aims to extend known ore bodies as well as investigate new mineralized zones in satellite targets. At Cerro Lindo, we plan to drill a total of 39,000 meters including detailing drilling at the Pucasalla target and extension drilling on other targets. At El Porvenir, we plan to drill 19,000 meters on satellite targets. At Vazante, we plan to drill 7,000 meters to test the extensions of the known orebody.

In terms of our greenfield projects, we will continue with our ongoing efforts to add resources and consolidate our pipeline. At Hilarión, we plan to drill 5,500 meters on satellite targets. At Aripuanã, the strategy is to drill 9,000 meters at Babaçu including extension and infill drilling, and 25,000 meters of infill drilling at the Ambrex and Link orebodies for Mineral Resources expansion and reclassification. At Bonsucesso, we plan to drill 8,800 meters of extension and infill drilling for Mineral Resource expansion. In Namibia, we plan to drill 10,000 meters to continue to investigate copper mineralization along the Deblin trend.

We seek to preserve our investments in projects around the mines we already operate, to fulfill our objective of prolonging their life of mine and invest in greenfield projects with the objective of developing new projects to achieve our growth strategy.

Nexa did not engage in exploration activities in 2021 at the Caçapava do Sul project, which has been suspended as a result of our current capital allocation strategy.

Mineral Reserves and Mineral Resources Tables

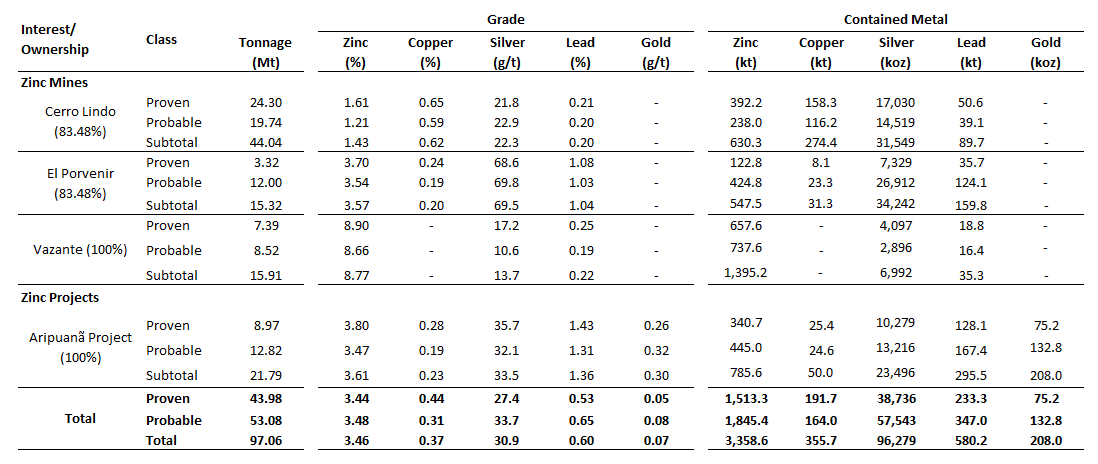

MINERAL RESERVES

The following table shows our estimates of Mineral Reserves prepared with an effective date of December 31, 2021 (except as indicated below).

Table 2. Nexa Year-End Mineral Reserves as of December 31, 2021 (except as indicated below) for Zinc operating mines and project.

NOTES TO MINERAL RESERVES TABLE

Mineral Reserves are expressed on a 100% basis. The Qualified Persons for the estimation of the Mineral Reserves for Cerro Lindo El Porvenir, Vazante, and the Aripuanã project is Jason J. Cox, P.Eng., a SLR Consulting (Canada) Ltd. employee.

Mineral Reserves have an effective date of December 31, 2021, for Cerro Lindo, El Porvenir and Vazante mines; and the Aripuanã project.

2014 CIM Definition Standards were followed for Mineral Reserves, which are consistent with definitions

used under Subpart 1300 of Regulation S-K.

Mineral Reserves are reported within engineered stope outlines assuming the following underground mining methods: El Porvenir and Vazante - SLS and C&F; Cerro Lindo - SLS; and the Aripuanã project - longitudinal longhole retreat (bench stoping) and transverse longhole mining (VRM). Dilution and mining recovery are considered.

At Cerro Lindo, Mineral Reserves are estimated at an NSR break-even cut-off value of US$38.73/t processed. Some incremental material with values between US$29.13/t and US$38.84/t was included. At El Porvenir Mineral Reserves are estimated at NSR cut-off values ranging from US$57.63/t to US$62.19/t depending on the zone and mining method. At Vazante Mineral Reserves are estimated at a cut-off grade of 4% Zn. At Aripuanã Mineral Reserves are estimated at an NSR break-even cut-off value of US$47.91/t processed. Some incremental material with values between US$39.79/t and US$47.91/t was included.

Metallurgical recoveries are accounted for in the NSR calculations based on historical processing data and are variable as a function of head grade. Forecast long-term metal prices used for the NSR calculation are Zn: US$2,722.20/t (US$1.23/lb); Pb: US$1,997.21/t (US$0.91/lb); Cu: US$7,228.26/t (US$3.31/lb); Ag: US$19.68/oz, and Au: US$1,454.12/oz for the Aripuanã project.

The exchange rate for Vazante, Brazil is R$/US$ rate of 4.98.

For Vazante and the Aripuanã project, a 4.0 m minimum mining width was applied. For Cerro Lindo and for El Porvenir a minimum mining width of 5.0 m was applied. Bulk density at Cerro Lindo and Aripuanã Bulk varies depending on mineralization domain. At Vazante the density is 3.1 t/m³ and El Porvenir is 3.12 t/m³.

Numbers may not add due to rounding.

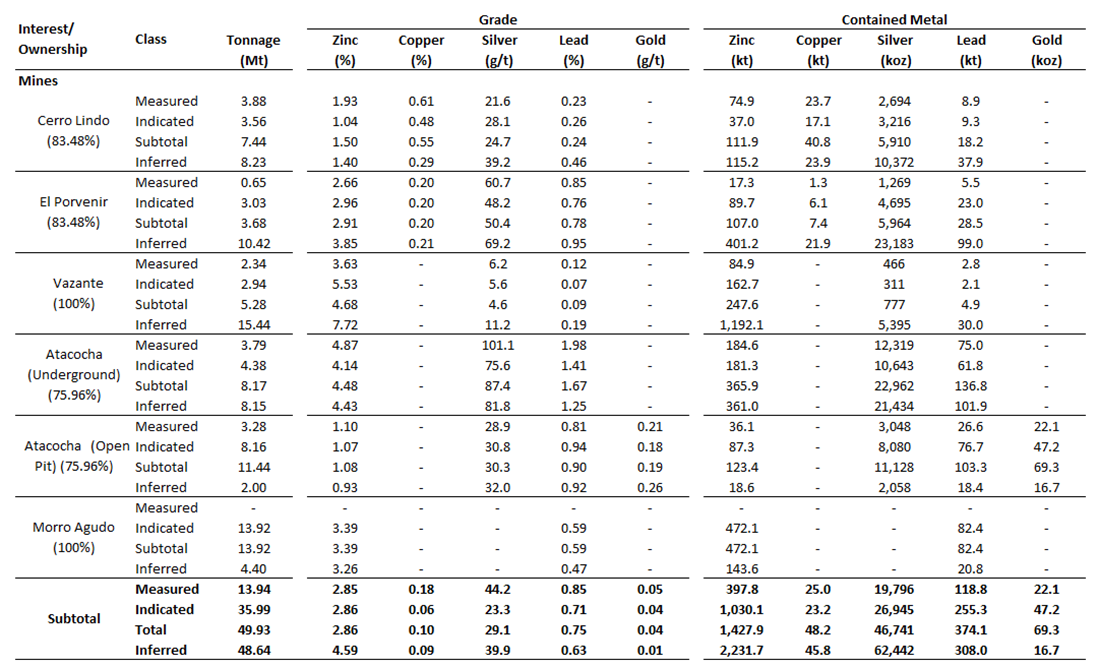

MINERAL RESOURCES

The following table shows our estimates of Mineral Resources (exclusive of Mineral Reserves) in operating mines prepared with an effective date of December 31, 2021 (except as indicated below).

Table 3. Nexa Year-End Mineral Resources as of December 31, 2021 (except as indicated below) for Zinc operating mines.

The following table shows our estimates of Mineral Resources (exclusive of Mineral Reserves) for our zinc exploration projects prepared with an effective date of December 31, 2021 (except as indicated below).

Table 4. Nexa Year-End Mineral Resources as of December 31, 2021 (except as indicated below) for Zinc projects.

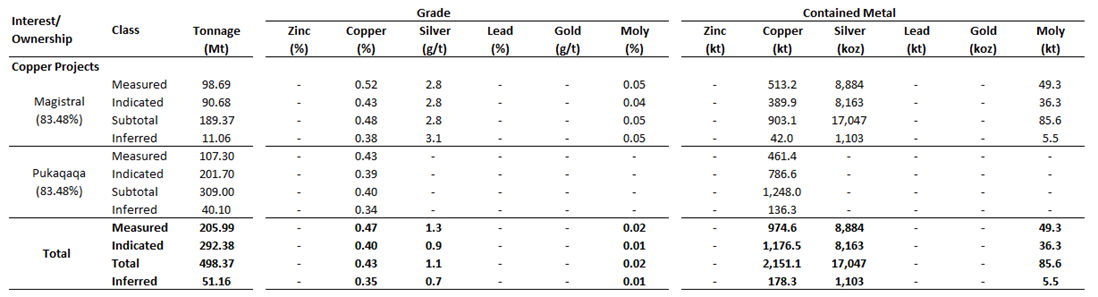

The following table shows our estimates of Mineral Resources for our copper projects prepared with an effective date of December 31, 2021 (except as indicated below).

Table 5. Nexa Year-End Mineral Resources for Copper projects.

NOTES TO MINERAL RESOURCES TABLES

Mineral Resources are expressed on a 100% basis.

The Qualified Persons for the estimation of the Mineral Resources are:

Cerro Lindo, El Porvenir, Atacocha (u/g and o/p), Vazante and Morro Agudo mines, and Aripuanã project, Shalipayco project, Pukaqaqa project, Florida Canyon project, Magistral project, Hilarión project and Caçapava do Sul project - José Antonio Lopes, B.Geo., FAusIMM (CP) Geo, a Nexa employee.

Mineral Resources have an effective date as of: (a) December 31, 2021, for Cerro Lindo, El Porvenir, Atacocha (u/g and o/p), Vazante, Morro Agudo and Aripuanã, Hilarion, Shalipayco and Magistral projects; (b) October 30, 2020, for the Florida Canyon project; (c) July 31, 2017, for the Pukaqaqa project; and (d) March 17, 2017, for the Caçapava do Sul project.

2014 CIM Definition Standards were followed for Mineral Resources, which are consistent with definitions used under Subpart 1300 of Regulation S-K.

Mineral Resources are reported within underground resource shapes for Cerro Lindo, El Porvenir, Atacocha u/g, and Morro Agudo mines and for the Aripuanã, Shalipayco, Hilarión and Florida Canyon projects. Mineral Resources are reported within underground resource shapes or within an optimized pit shell for Vazante and within an optimized pit shell for Atacocha open pit and Magistral, Pukaqaqa and Caçapava do Sul projects.

Mineral Resources are reported above a NSR cut-off value of: Cerro Lindo - US$38.84/t for resource shapes; El Porvenir - varies from US$59.24/t (lower zone) to US$62.18/t (upper zone) for C&F resource shapes and from US$57.45/t (lower zone) to US$60.39/t (upper zone) for SLS resource shapes; Atacocha u/g - US$63.68/t for C&F resource stopes; Atacocha o/p - US$18.17/t; Vazante - US$52.95/t for SLS resources shapes, Calamine - varies from US$20.33/t to US$22.18/t and Vazante Aroeira tailings - US$20.62/t; Morro Agudo (specific for each mine) - Morro Agudo: US$39.20/t and Bonsucesso: US$47.10/t; Aripuanã - US$47.91/t; Shalipayco - US$45/t; Hilarión - US$35/t for Hilarión Deposit and US$45.0/t for SLS and US$50.0/t for R&P resource shapes for El Padrino Deposit; Caçapava do Sul - US$13.25/t; Magistral - US$5.99/t for porphyry, US$5.51/t for mixed and US$5.48/t for skarn resources ; Pukaqaqa - Mineral Resources are reported above a 0.2% Cu cut-off grade; Florida Canyon - US$41.40/t for SLS resource shapes, US$42.93/t for C&F and US$40.61/t for Room and Pillar resource areas.

Forecast long-term metal prices used for the NSR calculation are: Cerro Lindo, El Porvenir, Atacocha (u/g and o/p), Vazante, Morro Agudo and Aripuanã - Zn: US$3,131/t (US$1.42/lb), Pb: US$2,297/t (US$1.04/lb), Cu: US$8,383/t (US$3.80/lb), Ag: US$22.63/oz and Au: US$1,672/oz (also used for Atacocha o/p); Shalipayco - Zn: US$3,034/t (US$1.38/lb), Pb: US$2,530/t (US$1.15/lb) and Ag: US$21.58/oz; Magistral project - Cu: US$7,193/t (US$3.26/lb), Ag: US$21.34/oz and Mo: US$9.90/lb; Hilarión project - Zn: US$2,957/t (US$1.34/lb), Pb: US$2,303/t (US$1.04/lb), Cu: US$7,523/t (US$3.41/lb) and Ag: US$19.61/oz; Caçapava do Sul project - Zn: US$2,778/t (US$1.26/lb), Pb: US$2,227/t (US$1.01/lb), Cu: US$6,790/t (US$3.08/lb) and Ag: US$21.78/oz; Pukaqaqa project - Cu: US$5,710/t (US$2.59/lb); and Florida Canyon project - Zn: US$2,816/t (US$1.27/lb), Pb: US$2,196/t (US$1.00/lb) and Ag: US$19.40/oz.

A minimum mining width of 4.0 m was used for Cerro Lindo. A minimum mining width of 4.0 m for C&F resource shapes was applied for El Porvenir, Atacocha u/g. A minimum thickness of 3.0 m for SLS and C&F, and 4.0 m for Room and Pillar in Florida Canyon project. A minimum mining width of 3.0 m was applied for Vazante for willemite mineralization, Bonsucesso, Hilarión and SLS and C&F stopes in Florida Canyon project. For Morro Agudo underground a minimum mining width of 4.5 m was applied. For Shalipayco project a minimum mining width of 2.0 m was applied. For the Magistral project a minimum mining width of 10.0 m was applied.

Mineral Resources are reported exclusive of those Mineral Resources that were converted to Mineral Reserves. There are no Mineral Reserves at Atacocha u/g and o/p and Morro Agudo, and at Shalipayco, Magistral, Hilarión, Pukaqaqa, Florida Canyon and Caçapava do Sul projects.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Numbers may not add due to rounding.

Technical Information

Jose Antonio Lopes, FAusIMM CP (Geo): 224829, a mineral resources manager, a qualified person for purposes of National Instrument 43-101 and a Nexa employee, has approved the scientific and technical information contained in this news release.

Further information, including key assumptions, parameters, and methods used to estimate Mineral Reserves and Mineral Resources of the mines and/or projects referenced in the tables above can be found in the applicable technical reports, each of which is available at www.sedar.com under Nexa's SEDAR profile.

About Nexa

Nexa is a large-scale, low-cost integrated zinc producer with over 60 years of experience developing and operating mining and smelting assets in Latin America. Nexa currently owns and operates five long-life underground mines - three located in the Central Andes of Peru and two located in the state of Minas Gerais in Brazil - and is developing the Aripuanã Project as its sixth underground mine in Mato Grosso, Brazil. Nexa was among the top five producers of mined zinc globally in 2021 and one of the top five metallic zinc producers worldwide in 2021, according to Wood Mackenzie.

Cautionary Statement on Mineral Reserve and Mineral Resource Estimates

All Mineral Reserve and Mineral Resource estimates of the Company disclosed or referenced in this news release have been prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards on Mineral Resources and Mineral Reserves dated May 10, 2014 ("2014 CIM Definition Standards"), whose definitions are incorporated by reference in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), for the metals indicated per mine and project. Accordingly, such information may not be comparable to similar information prepared in accordance with Subpart 1300 of Regulation S-K ("S-K 1300"). For a discussion of the differences between the requirements under S-K 1300 and NI 43-101, please see our annual report on Form 20-F.

Mineral reserve: is an estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted.

Probable Mineral Reserve: is the economically mineable part of an indicated and, in some cases, a measured mineral resource.

Proven Mineral Reserve: is the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource.

Mineral Resource: is a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable.

Inferred Mineral Resource: is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Indicated Mineral Resource: is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling.

Measured Mineral Resource: is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling.

Cautionary Statement on Forward-Looking Statements

This news release contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to in this news release as "forward-looking statements"). All statements other than statements of historical fact are forward-looking statements. The words "believe," "will," "may," "may have," "would," "estimate," "continues," "anticipates," "intends," "plans," "expects," "budget," "scheduled," "forecasts" and similar words are intended to identify estimates and forward-looking statements. Forward-looking statements are not guarantees and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of NEXA to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Actual results and developments may be substantially different from the expectations described in the forward-looking statements for several reasons, many of which are not under our control, among them, the activities of our competition, the future global economic situation, weather conditions, market prices and conditions, exchange rates, and operational and financial risks. The unexpected occurrence of one or more of the abovementioned events may significantly change the results of our operations on which we have based our estimates and forward-looking statements. Our estimates and forward-looking statements may also be influenced by, among others, legal, political, environmental or other risks that could materially affect the potential development of our projects, including risks related to outbreaks of contagious diseases or health crises impacting overall economic activity regionally or globally.

These forward-looking statements related to future events or future performance and include current estimates, predictions, forecasts, beliefs and statements as to management's expectations with respect to, but not limited to, the business and operations of the Company and mining production our growth strategy, the impact of applicable laws and regulations, future zinc and other metal prices, smelting sales, CAPEX, expenses related to exploration and project evaluation, estimation of mineral reserves and/or mineral resources, mine life and our financial liquidity.

Forward-looking statements are necessarily based upon several factors and assumptions that, while considered reasonable and appropriate by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies and may prove to be incorrect. Statements concerning future production costs or volumes are based on numerous assumptions of management regarding operating matters and on assumptions that demand for products develops as anticipated, that customers and other counterparties perform their contractual obligations, full integration of mining and smelting operations, that operating and capital plans will not be disrupted by issues such as mechanical failure, unavailability of parts and supplies, labor disturbances, interruption in transportation or utilities, adverse weather conditions, and other COVID-19 related impacts, and that there are no material unanticipated variations in metal prices, exchange rates, or the cost of energy, supplies or transportation, among other assumptions.

We assume no obligation to update forward-looking statements except as required under securities laws. Estimates and forward-looking statements involve risks and uncertainties and do not guarantee future performance, as actual results or developments may be substantially different from the expectations described in the forward-looking statements. Further information concerning risks and uncertainties associated with these forward-looking statements and our business can be found in our public disclosures filed under our profile on SEDAR (www.sedar.com) and on EDGAR (www.sec.gov).

Contact: Roberta Varella - Head of Investor Relations | ir@nexaresources.com

+55 11 94473-1388

SOURCE: Nexa Resources S.A.

View source version on accesswire.com:

https://www.accesswire.com/693608/Nexa-Resources-Announces-2021-Year-End-Mineral-Reserves-and-Mineral-Resources