Surge Battery Metals, Inc. (OTC Pink: NILIF) is ensuring it has the right pieces to accelerate an ambitious 2H/2023 exploration program at some of the world's most mining-friendly lithium and battery metals exploration jurisdictions. Most recently, NILIF announced another valuable addition to its BOD panel, adding industry veteran Iain Scarr to its Board of Directors. He compliments the appointment of Graham Harris, another industry veteran with a wealth of knowledge and expertise in capitalizing on opportunities and monetizing assets.

Mr. Scarr's resume is impressive. He served a 29-year tenure with Rio Tinto, including his position as Commercial Director and VP of Exploration, Industrial Minerals Division, which could be levered to open doors of opportunity to NILIF faster than many expected. Investors appear tuned into that potential. Since April, NILIF shares have increased by over 25% to $0.20 on Tuesday. And that run can't be attributed to just adding key C-level talent. NILIF is also well-positioned financially to accelerate 2H/2023 exploration programs after completing two private placements that have added about $3.4 million to NILIF's cash war chest, according to an interview published on May 8th.

In other words, what was a good start to 2023 has been made excellent with a strengthened balance sheet and talent additions enhancing an already attractive value proposition from Surge capitalizing on lucrative battery metals sector opportunities.

Demand For Battery Metals Is Soaring

The better news is that the demand curve for what Surge intends to supply, already at historic levels, is steepening. But here's even better news from a NILIF investor's perspective. More than positioned to address the need, NILIF boasts an asset portfolio that mitigates downside risk. In fact, unlike many sector peers, NILIF has assets in several of the world's most mining-friendly jurisdictions and, just as importantly, holds the necessary licenses and approvals to develop. Thus, while NILIF's $0.20 price per share may value the company as a microcap company, the more appropriate way to appraise this exploration company is by understanding how it can leverage its assets to create potentially enormous shareholder value in 2023. Even better, they may not need to drill to exploit their inherent value.

That's a potential result of being in the right sector with the right assets at the right time. Headlines have continuously exposed that companies like Tesla (NASDAQ; TSLA), Ford (NYSE: F), and General Motors (NYSE: GM) are doing everything they can to secure as much battery metal material as possible to fuel their EV ambitions. Tesla has certainly been open to showing its cards, recently saying it intends to create its own lithium production facility. Whether that's posturing rhetoric or a legitimate intent, the statement does provide a not-so-subtle message: companies appear willing to buy and/or source, no matter the cost, as many precious minerals and metals as possible to power their vehicles. That's excellent news for Surge Battery Metals. And the benefits can come pre or post-drill.

Remember, no matter how beautiful and enticing these automakers' vehicles are, they are merely showroom attractions without the batteries to power them. Thus, their need to secure a reliable supply chain is absolute to the success of their EV programs. And while some may opt to try and create their own source, the quickest and most efficient path to securing the battery metals needed is to connect with companies already positioned or positioning to deliver. NILIF makes that list of potentials. And better still, NILIF provides plenty of evidence that they will be able to grow in stride with the sector.

An Expanding Asset Base In Mining-Friendly Nevada

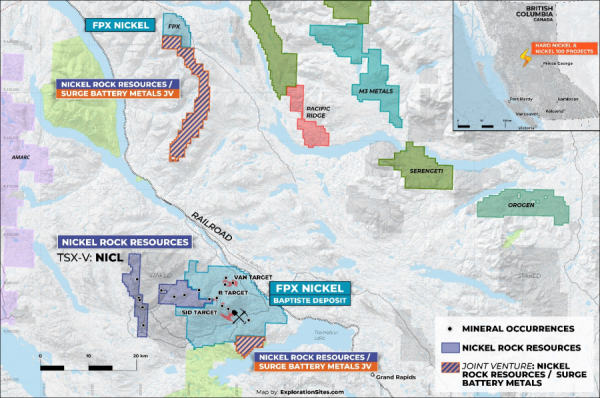

They strengthened that likelihood in April, announcing an option agreement with Nickel Rock Resources Inc. to acquire the remaining 20% interest in the HN4 and the N100 mineral claims in central British Columbia. This new agreement enhances an existing one where NILIF had a Property Option Agreement to earn an undivided 80% interest in specific mineral claims from Nickel Rock, a project comprising two non-contiguous mineral claims groups of six separate blocks in central British Columbia. They are of significant size and depth.

One of the claims in the Mount Sidney Williams area (claim HN4) covers 1863 hectares (approx 4603 acres) immediately south of and adjacent to the Decar Project. That project is already being advanced by FPX Resources, including 5 claims in the Mitchell Range area, northeast of Decar (N100 Group), covering 8659 hectares (approx 21,396 acres). Here's the benefit of Surge Battery. As a result of the newest consolidation agreement, Surge Battery Metals will own a 100% undivided ownership in the claims, three of them subject to 2% net service revenue. Both projects target the nickel/iron alloy mineral "Awaruite" and are hosted by serpentinized intrusive rocks of the Trembleur Ultramafic Unit that also hosts, regionally, two large-scale nickel/iron deposits under exploration and development by FPX Nickel Corp (OTC Other: FPOCF).

Once these claims transfer, the consolidation into a 100% ownership position in the HN4 and N100 group of claims provides NILIF with much greater flexibility when charting future exploration activities for the Surge Nickel Project. These properties have already demonstrated metallic mineralization, including nickel, cobalt, and chromium. Notably, while nickel and cobalt mineralization on the properties have yet to be intensely explored for nickel's presence in the nickel/iron alloy, awaruite has recently been documented. While all three present a trifecta of revenue-generating opportunity, developing the potential inherent to only the latter can justify and support a sustainable boost to NILIF's valuation.

Financially Able And Expertly Managed To Expedite 2023 Programs

Supporting that bullish sentiment is NILIF having the cash to keep programs active. Surge Battery completed two announced private placements that have raised enough capital to expedite and complete its 2H/2023 exploration programs. Funds raised are intended to, among other things, accelerate the development of its significant 2022 lithium clay discovery at its Nevada North Lithium Project (NNLP), a plan in motion after receiving approval from the Nevada Bureau of Land Management (BLM) permitting the next stage of drilling to further delineate this high-grade target.

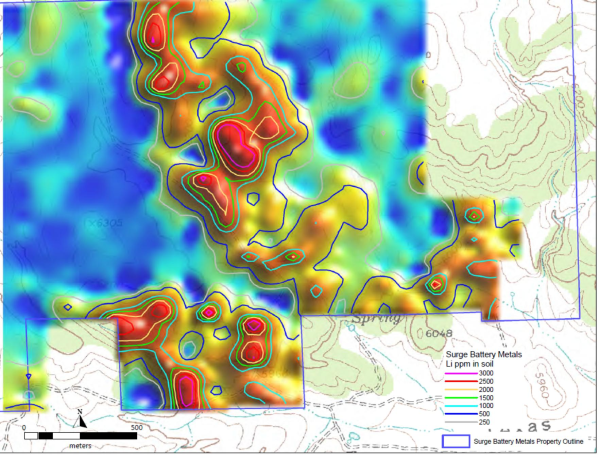

According to Surge management, plans include drilling seven new locations within an extensive surface geochemical covering an area of about 1,700 meters east-west in mid-May 2023, subject to weather conditions. The drill program will occur in two bands, each roughly 300 to 400 meters wide, outlining a highly anomalous zone containing abundant sample points greater than 1,000 ppm lithium with samples as high as 5,950 ppm. The better news about this program is that it can be transformational for the company, which can happen faster than many think after already earning approvals to commence the expanded drill program. In fact, that probability is in motion.

Related to its Nevada North Project and following the success of its 2022 drill program, value-creating opportunities for NILIF have increased, expected to strengthen further by the seven proposed drill locations to assess the deposit size of its lithium claystone resource at NNLP. The project's scope isn't random; these new drill targets have been selected to expand the currently identified lithium deposit to the west and north and determine continuity between the most northern and most southerly holes drilled in 2022's maiden drill program.

There is reason for optimism. The first round of drilling, completed in December 2022, identified a strongly mineralized zone of lithium clay mineralization over a strike length of almost 1,620 meters from NN2205 in the north to NN2208 in the south. Widths of the mineralized horizons, though not as well determined since the holes are mostly on a north-south alignment, are at least 400 meters wide, supported by highly anomalous soil values indicating the potential for these horizons to be much more significant. The industry language above is technical.

Stated more simply, what's been shown is the likelihood of a significant lithium deposit, a calculus supported by hole NN2207 which intersected the thickest intervals of lithium-rich claystone encountered to date, a total of 120.4 meters (395 feet) averaging 3,943 ppm lithium in four zones. Hole NN2208 had the most potent downhole individual sample of 5,950 ppm lithium between 45 and 50 feet (13.72 and 15.24 meters) of the maiden 2022 program. The company added that the average lithium content within all near-surface clay zones intersected in 2022 drilling, applying a 1000 ppm cut-off, was 3254 ppm. Said even simpler: NILIF appears to be sitting atop a mountain of valuable battery metals.

Optimism Supported By Many Factors

And investors are responding to that speculative presumption by igniting an appreciable rally that's gaining momentum. Deservedly so. Factoring just single parts of Surge's asset portfolio can support its current share price. But appraising NILIF in that way leaves out the intrinsic and inherent value of an asset portfolio, whose data indicates that NILIF could be sitting atop billions of dollars worth of precious battery metals. Thus, its bullish run since April could be the precursor of more gains, noting that NILIF plans to aggressively ramp up exploration activities in June. Notably, a steepening of its share price is warranted rather than wishful thinking.

In fact, Surge's Nevada Lithium Projects alone, where they own a 100% interest in 225 mineral claims located in Elko County, Nevada, can support and justify significantly higher valuations. But there's more contributing. Other assets include its Nevada North Lithium Project in the Granite Range southeast of Jackpot, Nevada. It targets value from a lithium clay deposit in volcanic tuff and tuffaceous sediments of the Jarbidge Rhyolite package. A third value driver is inherent to its Property Option Agreement to earn an undivided 80% interest in 16 mineral claims comprising 640 acres in Nevada's San Emidio Desert, known as the Galt Property. Recent mineral exploration produced encouraging samples showing a considerable means to turn ambitions into revenues.

While the above is plenty to encourage the bulls to continue their charge, another value driver is NILIF's 100% interest in 663 ha (1,640 acres) property in the Teels Marsh Project, located in Mineral County, Nevada. Considering NILIF's neighbors, don't underestimate or underappreciate the potential of this asset. In addition to location, it's in an active and historically prosperous region for lithium exploration and production.

All tolled using a sum of its parts to factor value, NILIF looks like a blue-chip exploration company disguised in a microcap price. The images above indicate being in the right areas at the right time and, more importantly, at them with permits in their possession. Those two distinguishing features do more than separate NILIF from the trove of penny stock exploration companies trying to raise money to exploit the massive opportunities inherent to the sector. They position NILIF to monetize its assets alongside the largest exploration and battery metals development companies. Of course, trading indicates investors are starting to recognize that possibility.

And with Surge better positioned today than when it scored its 52-week high of $0.37, reclaiming that level, about 85% higher than current, can be more than a target reached; it can be quickly breached.

Disclaimers: Shore Thing Media, LLC. (STM, LLC.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC. Has been compensated up to ten-thousand-dollars via cash wire by a third party to produce and syndicate content for Surge Battery Metals, Inc. For a two-week period ending on May 12, 2023. STM, LLC.has been previously compensated up to twenty-thousand-dollars via wire transfer to produce and syndicate content for Surge Battery Metals, Inc. for a period lasting one month ending on May 6, 2022. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website by visiting primetimeprofiles.com/disclaimers.The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 917-773-0072

Country: United States

Website: https://primetimeprofiles.com/