- We are on track as the company eCommerce Revenue Run Rate Increased from $10 Million to Over $36 Million with the recent Acquisition

- First Revenue Contribution from Bitcoin Mining Operations to be Recognized in the First Quarter as we started mining at the end of 2021

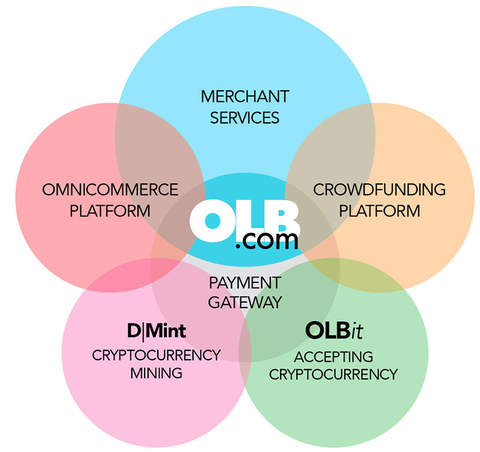

The OLB Group, Inc. (NASDAQ:OLB) a diversified Fintech eCommerce merchant services provider and cryptocurrency mining enterprise, issued the following open letter to shareholders today from Ronny Yakov, Chairman and CEO.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220505005251/en/

(Graphic: Business Wire)

Dear Fellow Shareholders:

We are pleased to provide you with an update on the substantial progress our business has made in 2021 and in the first three months of 2022 with our core business in eCommerce FinTech services and our expansion into Bitcoin mining.

As we grow and expand OLB, technology is constantly changing. We must adapt to new software and innovations in order to constantly be a cutting-edge company. We are also investing a tremendous amount of time and money to expand the infrastructure required to continue our expansion into new marketplaces and to take advantage of new technologies to provide our customers with many solutions for their business.

Our Mission

To facilitate brick &mortar store merchants with OmniCommerce solutions, combined with a financial Dashboard where they can manage their Business:

- Payments

- B2B payments management (vendors, suppliers)

- Inventory management

- Social media marketing

- Cash flow

- Loans

- Line of credit

- Employee's wages & benefits

Our Vision

To become a crypto charter bank. OLB will serve Omni commerce stores by bridging Crypto's new payment rails to the existing traditional payment system.

Businesses will soon be able to accept all kinds of payment methods, managing all financial needs, including NFT issuance/redemption/promotion (loyalty rewards for personal/secondary market usage).

Our focus is to be a one stop destination for small businesses, from managing your local business online, in-store, and on mobile. We are currently and will be offering additional services from accepting cryptocurrency payments to lending money to small merchants’ businesses. This gives them the ability to invest part of their profits and earn money through our services. Our vision is to become a one stop destination for all financial needs of small businesses.

With the threefold increase in our revenue base from our latest merchant portfolio acquisition (at a very attractive valuation of under 1X sales and 4X projected EBITDA), OLB’s eCommerce solutions are now utilized by over 10,500 merchants in over 150 industries in all 50 states of the U.S. In addition, our monthly transaction volume has also experienced healthy organic growth during 2021. This includes increases in transactions with larger merchants that have successfully navigated the challenges of this pandemic (by taking advantage of the disruption to their competitors).

eVance

eVance provides all needs to small businesses through a variety of services which compliment not only the merchant services, but also onboarding any merchant to our ecosystem. All the data is captured in one place—this includes merchant boarding, underwriting a merchant, risk monitoring, customer support, sales force, and residual payments.

This subsidiary supports all of our 10,500+ merchants. Our goal is to grow our base to 5 times what we are doing today, through acquisitions, organic growth, and an expansion of edit value services. A large part of this will come from our sister companies. We are looking to acquire companies or portfolios that we can purchase and will be self-financed with third party financing. All merchants that we manage have access to all services from those sister companies as well, including our proprietary payment gateway (that will offer crypto payments and conversion to USD).

Our recent acquisition of a portfolio of approximately 1,500 CBD product-related merchants has increased our annualized transaction volume to $1.35 Billion based on a trailing 12-month calculation of the transactions executed during 2021. OLB has the potential to see an increase of $20 million in new revenue and $5 Million in EBITDA with continued execution of similar transaction volumes. This would provide OLB with an annual revenue run rate from our eCommerce side of the business of approximately $30 Million to $36 Million per year. In the past few months, because of the relationships built with the merchants in the portfolio, we have been able to expand our new merchant base by an average of 120 new merchant accounts per month in this rapidly growing sector.

Omnisoft

Omnisoft is a subsidiary that is our R&D arm and develops all Omnicommerce applications that are fully customizable and are tailor-made solutions to individual merchants’ needs for online and in-store POS systems, and on mobile. Over the last year, we have achieved tremendous progress in the application side. We created an environment for some of our large clients in the cafeteria business. They can order online, pick up in front of the cafeteria, and/or self-served kiosks where any order goes directly to the kitchen for fulfilment. This even expands to creating a ticketing system for minor league baseball: customers can order tickets online, order from the concession stand, and/or purchase merchandise at the game (pre-order available as well).

We started with three teams and are expending to the fourth as we aim to add an additional 30 teams next year. After having that in place, we also plan to introduce NFTs to the ticketing system and some of memorabilia products.

We will continue to expand and improve our technology platform for our growing merchant base. Additionally, we announced that OLB will be able to process Mastercard Bitcoin payments as soon as it becomes available by Mastercard. Merchants utilizing OLB’s OmniSoft business management platform and the company’s SecurePay Payment Gateway for credit cards and ACH Platform, can activate Mastercard cryptocurrency transaction processing.

Crowd Pay & Crowd Ignition

Crowd Pay and Crowd Ignition are two subsidiaries that are critical to our future of providing total services. Crowd Pay is a platform for large service offerings that works on servicing Broker Dealers as SaaS. Crowd Ignition is a Regulation CF-regulated portal for crowd funding approved by FINRA, which we acquire this past January. It is complimentary to the capital raised specifically for small businesses, in which they can raise or borrow capital up to $5 million. The system will offer blockchain technology that will track the investments and loans for each offering.

DMINT

Last year, we secured the rights to purchase natural gas at extremely competitive prices to enable us to mine Bitcoin in Bradford, Pennsylvania. We have also purchased 1,000 Antminer S19j Pro cryptocurrency mining computers programed for the mining of Bitcoin. During 2021, we received 750 of the ordered machines. As of today, approximately half of them are fully operational and the remining 250 are due to come online before the end of the second quarter of 2022. Initially, we did face challenges in many parts of the business, from supply chain delivery issues to needing sufficient electrical power supplies and generators to operate in the location. We are anticipating the deliveries of the remaining mining machines before the end the second quarter this year. Additionally, we are exploring more locations with different power resources, starting anywhere from 10 MW and to 100 MW which would allow us to expand the operation. We believe that this mining operation will be a big boost to our overall objective and complimentary to our merchants. This will enable OLB to be able to lend funds to them from the capital that we generate from Bitcoin. We anticipate that we will have revenues of approximately $1 million a month from those machines alone (assuming a market price of Bitcoin’s of at least $45,000 over a 30-day period). We are confident that once we are able to procure on the additional power, we will be able to bring the additional machines online. We are also looking very carefully at the environmental impact and how OLB will be able to operate in an efficient manner. Once 1000 miners are in operation, we plan to explore other venues with this subsidiary and how to maximize all our existing shareholders’ value.

We plan to acquire more cryptocurrency mining machines towards our goal of operating up to 24,000 machines, focusing on using internally generated cash flow and debt financing, rather than using our equity to raise capital.

OLBit

This subsidiary is just a few months old and has been formed to hold and manage all the licenses that are required to operate OLB’s planned money transmission and lending business, including a Bitlicense from the State of New York, as well as a money transitions license in all 50 states. That is the first step towards our lengthy process to apply to become qualified to operate as a charter bank.

Once our licensing is in place, it will allow us to have the ability convert payments made using cryptocurrency into fiat currency and to be able to have a platform to allow our merchants to trade cryptocurrencies.

Recently, we updated our Investor Presentation and Investor Fact Sheet to reflect our business expansion into Bitcoin mining and both are now available to all investors and the public at www.olb.com/investor-data.

We plan to report our first quarterly contribution to revenue and income from our cryptocurrency mining operations, along with our first full quarter of revenue and income recognition from our CBD products merchant portfolio acquisition in the First Quarter 2022.

1st Quarter Earnings will be on May 12, 2022 at 4:15 EST

Link for Participants to Register for the Listen Only Conference Call

Conference ID: 80513

Direct Event Registration Link:

https://conferencingportals.com/event/csGMIMOL

Link for Participants to Register for the Webcast and to Ask a Question

Audience URL:

Use this link to access the audience view of the webcast. This URL can be distributed for posting on various websites or for inclusion in email notifications.

https://event.on24.com/wcc/r/3778731/0ABA94F167FA2CC8BFB70A9053CFAE01

Respectfully,

Ronny Yakov, CEO

Future OLB Press Releases and Updates

Interested investors or shareholders can be notified of future Press releases and Industry Updates by e-mailing: investorrelations@olb.com

About The OLB Group, Inc.

The OLB Group, Inc. is a diversified Fintech eCommerce merchant services provider and Bitcoin crypto mining enterprise. The Company's eCommerce platform delivers cloud-based merchant services for a comprehensive digital commerce solution to over 10,500 merchants in all 50 states. DMint, a wholly owned subsidiary of OLB Group, is engaged in the mining of Bitcoin utilizing sustainable natural gas with an initial deployment of efficient 1,000 ASIC-based S19j Pro 96T mining computers projected by end of 2021.

For more information about The OLB Group, please visit https://www.olb.com and www.olb.com/investors-data

If you want to post a question to the company management you can email us at InvestorRelations@OLB.com or post a question online at https://olb.com/investors-faq/

You can also register to see our independent valuation report at https://olb.com/valuation-report/

Safe Harbor Statement

All statements from The OLB Group, Inc. in this news release that are not based on historical fact are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, but are not limited to, statements concerning the impact of COVID-19 on our operations and financial condition, our ability to implement our proprietary merchant boarding and CRM system and to roll out our Omni Commerce and SecurePay applications, including payment methods, to our current merchants and the integration of our secure payment gateway with our crowdfunding platform, our ability to successfully launch a cryptocurrency mining operation and our ability to earn revenue from the new operations. While the Company’s management has based any forward-looking statements contained herein on its current expectations, the information on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties, and other factors, many of which are outside of our control, that could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors include statements regarding the expected revenue and income for operations to be generated by The OLB Group, Inc. For other factors that may cause our actual results to differ from those that are expected, see the information under the caption "Risk Factors" in the Company’s most recent Form 10-K and 10-Q filings, and amendments thereto, as well as other public filings with the SEC since such date. The Company operates in a rapidly changing and competitive environment, and new risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. The Company disclaims any intention to, and undertakes no obligation to, update or revise any forward-looking statement.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220505005251/en/

Contacts

OLB Group Investor Relations

Rick Lutz

InvestorRelations@OLB.com

(212) 278-0900 Ext. 333