Sarah Jacobs

- Amazon's private label products are losing brand share amid COVID-19, despite a surge in online shopping as more people buy online instead of going to a physical store, according to data from investment firm UBS.

- Even popular Amazon-owned products, like baby wipes and batteries, saw their share among the top 100 best selling brands drop by over 5% last month, according to UBS.

- Amazon's private label business has been an area of focus in recent years, as it launched hundreds of brands in apparel, supplements, and diapers, among other categories.

- Investment firm SunTrust Robinson Humphrey previously estimated that Amazon's private label business would generate $25 billion by 2022.

- Visit Business Insider's homepage for more stories.

Despite an overall surge in online shopping during the coronavirus pandemic, Amazon's private label products are losing brand share across the board, according to a new report from investment firm UBS, published this week.

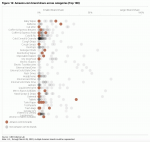

Based on UBS's proprietary database of over 200 million products and 300 brands on Amazon, the report shows that over the month of March, the brand share of Amazon's private label products in some key categories either stayed flat or declined. Popular Amazon-labeled products, like baby wipes and batteries, saw their share among the top 100 products in those categories drop by over 5% month-over-month, while shares of its vitamin and trash bag products were largely unchanged, according to the report.

The report also highlights that Amazon's overall brand share of its private label products is meager compared to other top sellers. Nearly all of its products had below 10% brand share of the 100 best sellers in their respective categories in March, with only batteries and baby wipes earning around 20% brand share and tablets, by far the strongest, with ~35%.

Private labels have been an area of focus for Amazon in recent years, as it launched hundreds of new brands across multiple categories, like apparel, supplements, and diapers. The business could generate an estimated $25 billion in sales by 2022, according to investment firm SunTrust Robinson and Humphrey, which pegged 2018 sales at $7.5 billion. Research firm Marketplace Pulse had a much lower estimate of below $1 billion in 2018 (though it excluded sales from Amazon's hardware devices and Whole Foods products).

Amazon itself doesn't disclose sales from its private label business, though it did say in April 2019 that private label products only account for "about 1%" of its total sales, far less than the 25% or more seen at other traditional retailers. There are signs Amazon's trying to change that. Its practice of aggressively promoting its private label brands has drawn criticism from sellers and lawmakers who say that it's giving an unfair advantage to its own products.

The UBS data suggests that its tactics haven't driven a meaningful result, at least in March. Amazon is seeing a huge increase in demand for essential products as more people shop online because of COVID-19, but Amazon-branded toilet paper and disinfectant wipes both saw their shares slip over the past month, according to UBS.

Here's the UBS chart that shows month-over-month change in brand share for Amazon private label products among the 100 best sellers as of March 28:And this UBS chart shows the brand share of Amazon's private label products among 100 best sellers across each category as of March 28:NOW WATCH: How autopilot on an airplane works

See Also:

- Amazon is 'pausing' its own shipping service that it was beta testing in the US — read the memo it just sent sellers

- Amazon employees learn about their new salaries starting this week — and most will use it to guess last year's performance rating because managers don't usually share it

- Amazon has finally told sellers that it will not charge them for several fees after the company banned them from stocking non-essential items last month